And if your business is still not yet eligible for SBA funding, we will be honored to work together until we secure the much-needed financing.

Talk to one of our specialists, and he or she will evaluate your business’ needs, explain the pros and cons of each program, and help you decide which program is right for you. If you’re not sure which loan program is right for you, GoKapital can help.

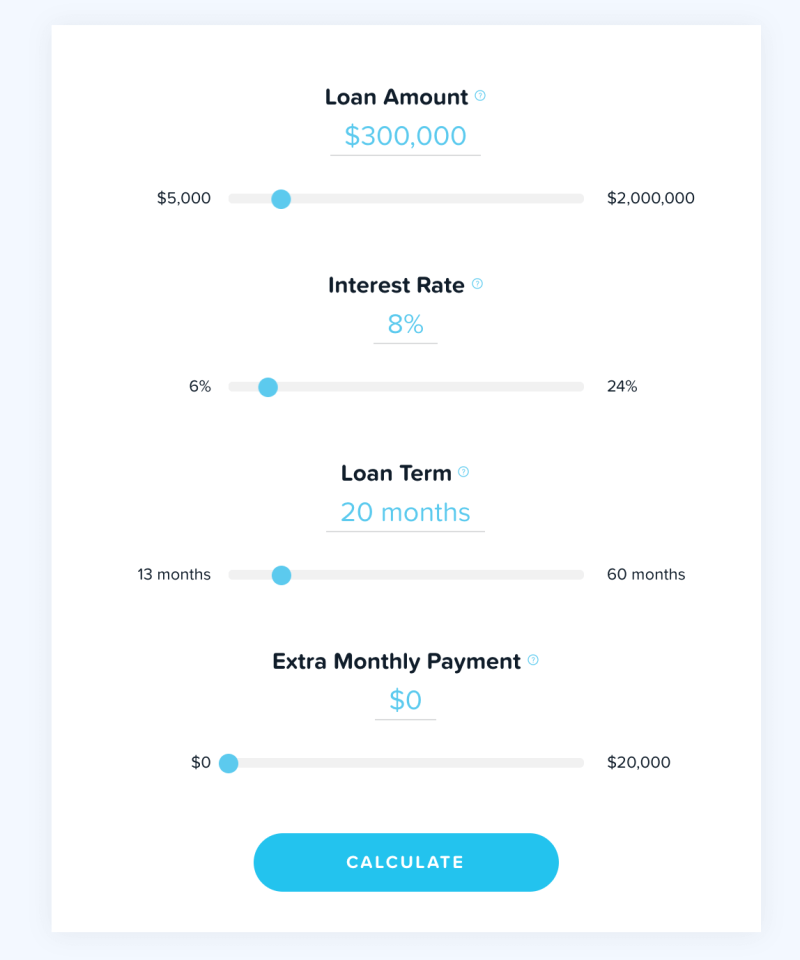

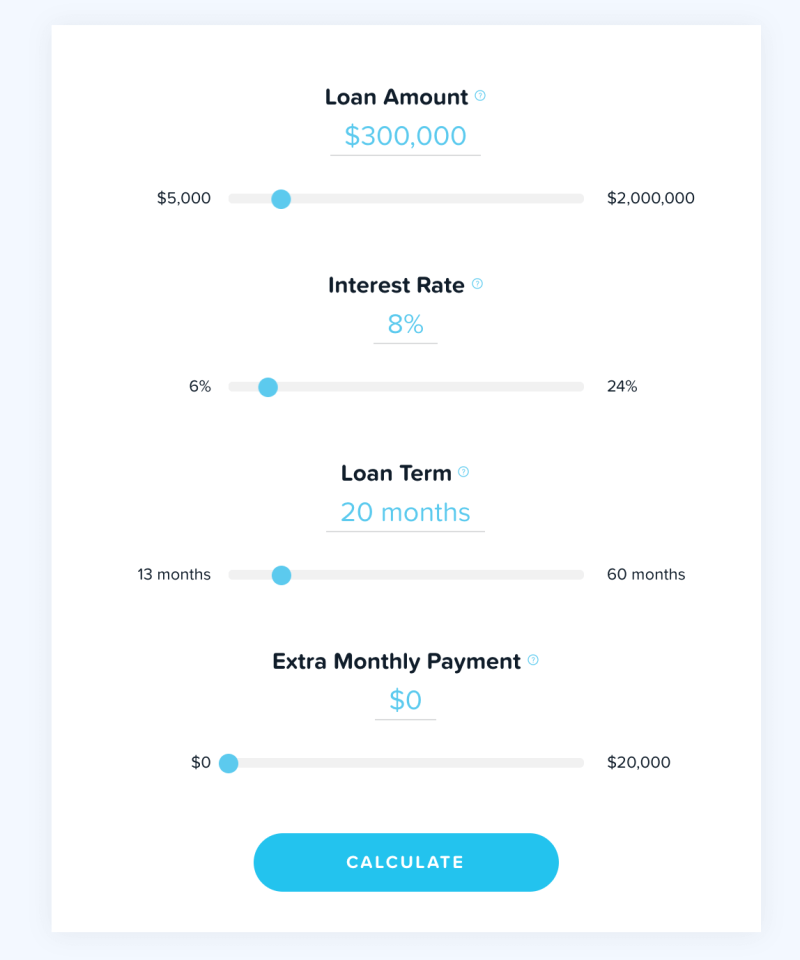

Business must have an average net income less than $5 million after taxes for the preceding two years. Business must have a net worth of less than $15 Million. Note: Our loan calculator is only an estimate. Decide what payment you can afford and adjust numbers accordingly. Then, enter a loan amount, interest rate, and loan period. First, select the type of loan you wish to calculate: Home, Business, or Personal. However, these businesses have to occupy at least 51 percent of the commercial building. Use our VA loan calculator to calculate your loan payments. It requires a low down payment (Starting at 10%) and provides fixed interest rates with long repayment periods.ĬDC/504 loans are popular among businesses that are planning to buy or build owner-occupied commercial properties. The Certified Development Company (CDC) loan was designed for businesses that wish to purchase fixed assets for expansion or modernization such as business equipment, machinery, furniture, or commercial real estate. It is important to remember that the Small Business Administration doesn’t lend money directly to small business owners, instead, it sets guidelines for loans made by its partnering lenders. Therefore, reducing the risk for lenders translates into flexible terms, low annual percentage rates (APR), low-interest, and low down payments for borrowers. With these government-backed loan programs, the Small Business Administration is helping entrepreneurs, veterans, women, and minorities get easy access to lending opportunities by offering banks and private lenders a partial repayment in case the businesses defaults on their payments. Small Business Administration, and are issued by authorized lenders such as GoKapital. With flexible terms and low-interest rates that are accessible to American business owners and entrepreneurs who have well-established businesses with strong credit history.Īn SBA loan is a form of conventional financing that has very stringent requirements, which are partially guaranteed by the U.S.

A small business loan backed by the U.S Small Business Administration is the most affordable way to finance your business.

0 kommentar(er)

0 kommentar(er)